This morning, ImmoStat announced the figures for the 2nd quarter of 2023 concerning investments made by institutional investors and family offices in the bulk sale of both traditional and managed residential assets.

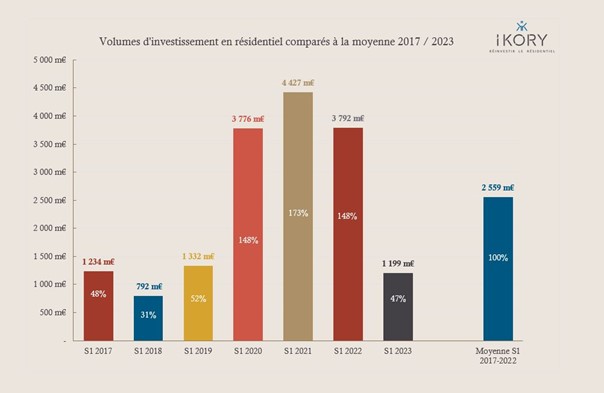

In total, €662 million were invested in residential assets during the second quarter of 2023. As a result, the total investment in residential real estate for the first half of 2023 amounts to €1.2 billion, representing a decrease of 68% compared to the first half of 2022. However, it is worth noting that the second quarter of 2023 shows a slight increase compared to the second quarter of 2022.

Breaking down the figures for the second quarter, €428 million were invested in traditional, intermediary, and intergenerational asset types, totaling €776 million for the first half of 2023. As for managed residential assets (senior residences, student accommodations, and co-living spaces), €234 million were invested this quarter, totaling €424 million for the first half of 2023.

Despite the evident decrease in invested amounts compared to the first half of 2022 (75% for traditional residential assets, 40% for managed assets), it is noteworthy that this second quarter experienced a 24% increase compared to the first quarter of 2023 (+28.9% for traditional assets and +18.1% for managed assets).

“The decrease in residential investment volumes in the 1st semester of 2023 reflects the cautious approach of institutional investors, who had to adjust their return rate expectations,” said Eric Fintz, Deputy CEO of Ikory. “In this contracting context, we observe the return of opportunistic and core+ funds, betting on a medium-term rebound in the residential market and seeking to capitalize on the difference between bulk and subdivision.”

Download the press release here: [IKORY-Press Alert ImmoStat Figures Q2 2023 ]