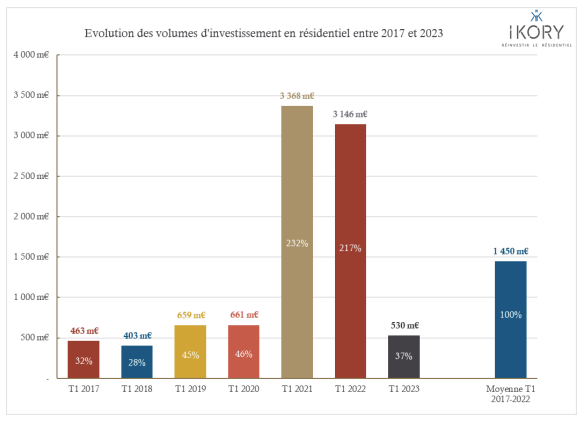

This morning, ImmoStat unveiled the figures for the first quarter of 2023 regarding investments made by institutional and family office investors in the bulk sale of residential assets, both traditional and managed.

In total, €530 million has been invested in residential assets in the early months of 2023. In detail, €332 million has been recorded for traditional asset types, and €198 million for managed assets (senior residences, student housing, and coliving). This reflects an overall decrease of 83% compared to the first quarter of 2022 (a decrease of 88% for traditional residential real estate and 51% for managed residential real estate).

The beginning of the year should be viewed in the context of the stances taken by different players in the residential sector, ranging from a wait-and-see approach to the pursuit of new opportunities.

“The attrition in the investment market that we are witnessing is an expression of the transformation of residential sector players,” said Eric Fintz, Deputy CEO of Ikory. “Core investors are holding back, expecting increased yield rates. On the other hand, social landlords and operators in fractional ownership are very active. Furthermore, we are beginning to see opportunistic funds and property developers reemerge, entities that had stayed out of the market in recent years and are being drawn back due to the reestablishment of the discount between bulk purchases and individual units.”

Download the press release here: [IKORY-Press-Alert-Figures-ImmoStat-Q1-2023]